Recommended

Gasoline Price Prediction 2024-2030: What Will Gas Price Be in Next 5 Years?

2024/05/08By:

Gas Price Prediction 2026

Gasoline Price Prediction Overview:

- The current price of gas is $5.17 USD, according to our real-time GAS to USD price update.

- Our analysis of petrol prices indicates that by May 8, 2024, the price of petrol could have decreased by -13.35%.

- According to our technical indicator analysis, the market is currently feeling bearish, with a fear and greed index score of 71 (greed).

- Petrol has experienced 10.53% price volatility and 16/30 (53%) green days over the past 30 days.

Trade on BTCC with 10 FREE USDT.

Signup today to redeem your bonus.

| Download App for Android | Download App for iOS |

Gas Price History

The most recent data shows that Gas is currently priced at $5.19 and is rated #190 in the overall cryptocurrency ecosystem. There are 64,992,331 GAS in circulation, and the market cap is $337,436,874.30.

The cryptocurrency has had a $0.03 boost in value during the last 24 hours.

There has been a solid upward trend for GAS over the past week, leading to a 4.66% increase. Recent petrol prices have been somewhat high, so now might be a good time to get in and make an investment.

The price of GAS has climbed by 16.62% in the past month, bringing its present value up by an enormous $0.86 on average. Because of its unexpected surge in value, the coin has the potential to become a reliable investment in the near future.

What’s Affecting the Gas Price: Why is Gasoline Falling?

RBOB gasoline futures opened 2022 strong at the $2.25/gal level in early January and continued to surge following Russia’s invasion of Ukraine on 24 February.

On 8 March, the futures soared to a new all-time high of $3.83/gal after the US, the UK and the European Union announced a ban on Russian energy imports as a sanction for the country’s invasion of Ukraine.

The announcement caused the Brent crude oil benchmark, the largest component of the gasoline price, to hit $139 a barrel. According to the US Energy Information Administration (EIA), crude oil cost 54% the price of a gallon of gasoline in October. Refining charges accounted for 22% of the fuel’s value, with taxes, distribution and marketing accounting for the remaining 24%.

“The gasoline price benchmark surge is driven by elevated crude oil prices and widening gasoline crack spreads on the back of diminishing refining capacity,” wrote Dominika Rzechorzek, an oil and gas analyst at Fitch Solutions.

“The most significant bullish factor currently impacting oil prices is the ongoing fallout from the Russia-Ukraine conflict. Prices have stayed elevated in the wake of Russia’s invasion of Ukraine, reflecting supply disruptions stemming from the conflict itself, as well as Western sanctions in place on Russia.”

Crack spreads are the price differences between wholesale petroleum products and crude oil. They are frequently used to calculate refining margins. Gasoline crack spreads have grown to average $50.1/bbl in May-June 2022 from $17.2/bbl in 2021, driven by diminishing refining capacity, according to Rzechorzek.

On the demand side, gasoline demand increased sharply as Covid-19 restrictions were lifted and reached just above 2019 levels at 10.4 million barrels per day (mb/d) by June, according to ANZ Research’s senior commodity strategist Daniel Hynes and commodity strategist Soni Kumari in a note on 3 November.

| Download App for Android | Download App for iOS |

Tight Supply Offsets Consumption of Soft Oil

Oil prices and fuel prices have retreated over the past few months. The Brent crude price has eased since last March to around $79.71/bbl at the time of writing on 24 February 2023, dropping about 7.2% year to date (YTD).

According to the AAA, retail gasoline prices in the US have also dropped about 34.5% to $3.285/gal in January this year from their all-time high of $5.016/gal recorded last summer.

According to Fitch Solutions, global oil supply will improve but markets will remain tight through 2023, with only moderate relief from high prices punctuated by bouts of volatility. The firm’s analysts wrote on 5 December 2022:

“Fears of a decline in supply due to a restrictive price cap on Russian crude are easing, and loss of supply stemming from Europe’s ban on seaborne crude is expected to be manageable. Despite production cuts from OPEC+ and tempered US shale growth, on balance we expect markets will be kept from tipping back into undersupply, as consumption eases, allowing for stocks to rebuild and paving the way for lower prices.”

IEA, in its December oil market report, forecast oil demand growth could slow to 1.6mb/d in 2023, from 2.3mb/d in 2022 as economic headwinds mount. World oil consumption was expected to reach 101.6mb/d in 2023.

On the supply side, crude oil supply growth is expected to slow to just 770kb/d in 2023, compared to 4.7mb/d gains in 2022, as the EU ban on Russian crude imports and the G7 price cap come into effect.

According to ANZ Research, OPEC+’s production cut and the EU’s sanctions on Russian oil could remove 2.5mb/d of oil supply from the market over the coming months, which would keep the market tight.

“The oil market is in a fundamentally stronger position than it has been in previous economic downturns. Stocks are relatively low and ongoing supply issues should offset the slowing growth in demand,” according to Hynes and Kumari.

China’s Crude Demand Returns to the Market

Global economic headwinds were expected to slow demand growth for oil and gas in 2023, dragged down by economic downturns in developed markets due to high interest rates and inflation. According to Fitch Solutions, total fuel consumption in developed markets will rise at a 0.5% annual rate in 2023.

In contrast, emerging markets will provide the bulk of growth in fuel consumption for 2023, in line with a stronger economic performance, the firm added.

The expected rebound in China’s energy demand after it ended its three years in Covid-19 self-isolation was expected to cushion the fall in global energy demand. Fitch Solutions projected China’s gross domestic product (GDP) growth at 5% for 2023, faster than global economic growth of 2%.

“The return of China’s crude demand to markets from both higher internal domestic consumption and increased exports of refined fuels will help buoy global fuel consumption growth for 2023. We forecast China’s fuel consumption to grow by 5.0% in 2023 in line with the strong return to growth expected,” the firm stated.

China has scrapped Covid-19 nucleic acid tests for international arrivals starting from 8 January. The country is gradually increasing the number of flights and optimise the distribution of routes.

| Download App for Android | Download App for iOS |

Gasoline Price Prediction | Analysts Say

In a recent note , analysts at Fitch Solutions wrote that while gasoline prices have come off their highs, they would remain elevated above historic averages. Consumption growth in emerging markets was expected to offset declines in developed markets, while low inventories globally and a continued lack of new refining capacity growth will contribute to a tight fundamental outlook, albeit much improved from earlier this year.

The firm stated that there are several risks to its gasoline price forecast, but they are skewed to the downside due to the emerging effects of the broader macroeconomic slowdown.

“Although, not our core view, a more severe economic downturn would further reduce gasoline consumption and pressure prices lower. In addition, sustained high inflation in 2023 would force central banks to continue raising interests further, deepening the economic impacts of lower growth in economic activity and fuel consumption,” analysts at Fitch Solutions.

China’s emergence from its zero-Covid policy will also impact gasoline consumption, but the country’s demand could be much lower than expected, the company added.

Gas Price Prediction 2024

In 2024, the lowest price of petrol will be $4.48, according to the technical analysis of those prices. The petrol price can go no higher than $5.84. Predictions place the average trade price at about $7.19.

Gas Price Prediction May 2024

Crypto experts predict that in May of 2024, the average GAS cost will be $5.05 based on the price swings of Gas in early 2023. You can anticipate a minimum price of $4.48 and a maximum price of $5.62.

Gas Price Prediction June 2024

The GAS price prediction for June 2024 has been finalised by the cryptocurrency specialists. During this month, the lowest possible trading cost is $5.17 and the highest possible cost is $6.06. The going rate for petrol is probably going to be around $5.62.

Gas Price Prediction July 2024

Based on their research into gas price trends from 2023 and beyond, crypto experts estimate that the average GAS pricing would reach $6.13 in July 2024. As a floor, it can fall as low as $6.01. The highest possible amount might be $6.24.

Gas Price Prediction August 2024

Midway through 2023, the average price of GAS will be $6.09. The petrol price might rise to $6.19 in August 2024 as well. Assumption: By August 2024, the price will have risen above $5.98.

Gas Price Prediction September 2024

Crypto specialists have done the maths on petrol prices in 2023 and can now give you their best guess for September 2024 trading average: $5.66. The petrol prices may be as low as $5.17 and as high as $6.14.

Gas Price Prediction October 2024

Crypto experts predict that GAS will be valued at approximately $5.70 by the end of summer 2023. The price of petrol might fall to $5.28 at the very least in October 2024. October 2024 can see a peak value of $6.12.

Gas Price Prediction November 2024

Experts in the cryptocurrency market have studied gas costs and are predicting that by November 2024, the GAS rate would hit $6.38. Nonetheless, it might fall as low as $5.50. The projected average price of petrol for November 2024 is close to $5.94.

Gas Price Prediction December 2024

Midway through the autumn of 2023, the average price of petrol will be $6.74. The GAS price can range from $6.23 to $7.25 in December 2024, according to crypto experts.

| Download App for Android | Download App for iOS |

Gas Price Prediction 2025

After the analysis of the prices of Gas in previous years, it is assumed that in 2025, the minimum price of Gas will be around $$8.78. The maximum expected GAS price may be around $$10.54. On average, the trading price might be $$9.10 in 2025

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2025 | $4.84 | $7.35 | $6.23 |

| February 2025 | $5.20 | $7.51 | $6.62 |

| March 2025 | $5.56 | $7.67 | $7.02 |

| April 2025 | $5.91 | $7.83 | $7.41 |

| May 2025 | $6.27 | $7.99 | $7.80 |

| June 2025 | $6.63 | $8.15 | $8.19 |

| July 2025 | $6.99 | $8.30 | $8.58 |

| August 2025 | $7.35 | $8.46 | $8.97 |

| September 2025 | $7.71 | $8.62 | $9.37 |

| October 2025 | $8.06 | $8.78 | $9.76 |

| November 2025 | $8.42 | $8.94 | $10.15 |

| December 2025 | $8.78 | $9.10 | $10.54 |

Gas Price Prediction 2026

| Download App for Android | Download App for iOS |

Gas Price Prediction 2026

In 2026, the lowest and highest prices for GAS, according to the technical analysis of cryptocurrency specialists, are projected to be approximately $12.73 and $15.30, respectively. The typical anticipated cost of trading is $13.09.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2026 | $9.11 | $9.43 | $10.94 |

| February 2026 | $9.44 | $9.77 | $11.33 |

| March 2026 | $9.77 | $10.10 | $11.73 |

| April 2026 | $10.10 | $10.43 | $12.13 |

| May 2026 | $10.43 | $10.76 | $12.52 |

| June 2026 | $10.76 | $11.10 | $12.92 |

| July 2026 | $11.08 | $11.43 | $13.32 |

| August 2026 | $11.41 | $11.76 | $13.71 |

| September 2026 | $11.74 | $12.09 | $14.11 |

| October 2026 | $12.07 | $12.43 | $14.51 |

| November 2026 | $12.40 | $12.76 | $14.90 |

| December 2026 | $12.73 | $13.09 | $15.30 |

Gas Price Prediction 2030

Cryptocurrency market analysts predict petrol prices annually. In 2030, the predicted range for the price of GAS is $59.75 to $70.42 per barrel. On average, you can expect to pay about $61.84 each year for it.

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January 2030 | $42.23 | $43.42 | $49.45 |

| February 2030 | $43.83 | $45.10 | $51.35 |

| March 2030 | $45.42 | $46.77 | $53.26 |

| April 2030 | $47.01 | $48.45 | $55.17 |

| May 2030 | $48.60 | $50.12 | $57.07 |

| June 2030 | $50.20 | $51.80 | $58.98 |

| July 2030 | $51.79 | $53.47 | $60.89 |

| August 2030 | $53.38 | $55.14 | $62.79 |

| September 2030 | $54.97 | $56.82 | $64.70 |

| October 2030 | $56.57 | $58.49 | $66.61 |

| November 2030 | $58.16 | $60.17 | $68.51 |

| December 2030 | $59.75 | $61.84 | $70.42 |

| Download App for Android | Download App for iOS |

Impact of Renewable Energy on Gas Prices

The increased cost of gasoline has brought attention to the West’s reliance on fossil fuels. This fresh understanding has increased people’s enthusiasm for green energy projects.

The Biden administration has announced plans to promote American solar production with a $82 million investment. Boosting domestic production of renewable energy sources is a priority for Vice President Biden.

The United States has also committed to expanding the manufacturing capacity for electric vehicles and the supporting infrastructure. Two of these include increasing the availability of electric vehicle charging stations across the country and getting major automakers to increase their EV sales to 50% by 2030.

Competition in the energy sector, which has long been dominated by crude oil and other fossil fuels, is sparked by this interest in renewable energy. As more countries adopt alternative energy options, increased competition could lead to a decrease in the price of crude oil.

These data lend credence to optimistic forecasts for gas prices over the next five years. Some analysts, however, believe that OPEC would fight this shift by supporting crude oil prices.

Predictions for Gasoline Prices Continue to Alter

Predicting gas prices for the next five years is extremely challenging in light of the current global situation. Despite short-term predictions of lower gas prices as the market stabilizes, they are expected to remain high as China’s grip on the global economy tightens and Russia’s aggressiveness in Ukraine continues.

As investments in renewable energy begin to pay off, the price of crude oil is expected to rise. Although we can hold out hope that costs will remain manageable, it’s possible that they will set new highs over the next five years and beyond.

| Download App for Android | Download App for iOS |

FAQs

Is gasoline a good investment?

Fitch Solutions and ANZ Research projected gasoline demand to soften in 2023 due to expected slowing economic growth in developed countries. This could hit the price and lead to potential losses. On the other hand, based on the historical data, algorithm forecasting service Wallet Investor predicted that RBOB gasoline futures should be a very good investment for long-term.

Will gasoline price go up or down?

Nobody knows for certain. The gas prices are expected to fall in the medium term, according to the US EIA, Fitch Solutions and Trading Economics, as the global economy slows and inventories rise.

Do note, however, that analysts’ views and forecasts are not a substitute for your own research and due diligence.

What will the price of gasoline be in 2023?

The EIA forecast that the retail gasoline price would average $3.51/gal in 2023, down from $3.99/gal in 2022. Fitch Solutions predicted the gasoline price to stand at $2.70/gal in 2023, while Wallet Investor expected the fuel price to reach $2.793 by December 2023.

Will gasoline ever run out?

As gasoline is produced from crude oil and other petroleum liquids, its availability is directly linked to the supply of oil. In early 2021, Swiss-based energy company MET Group predicted global oil reserves to last another 51 years. Other sources suggest that the planet will run out of fossil fuels much sooner. Much will depend on how quickly countries transition to clean energy.

How to Trade Crypto Futures on BTCC?

Now you can trade BTC on BTCC. BTCC supports a diverse selection of cryptocurrencies for trading. This includes popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and others. BTCC also offers products such as crypto, gold, and tokenized stocks to help investors rationally allocate their assets.

1. Register an Account

Join BTCC now and get up to 10,055 USDT when you deposit and trade. Click the button below to sign up now.

2. Deposit Funds

Once your account is set up, you’ll need to deposit funds into your BTCC account. BTCC may offer various deposit methods such as bank transfers, cryptocurrency deposits, or other payment options. Choose the method that works best for you and follow the instructions provided to deposit funds into your account. BTCC mainly offers USDT margin and future trading. Therefore, you need to buy USDT before trading.

3.How to trade BTC?

Here are the steps to trade BTC on BTCC

1) First, tap “Futures” on the website homepage

2) Select a product you would like to trade from the list here. BTCC currently offers daily and perpetual futures

3) Check time to settlement. The settlement time of these futures type is different, you can check the time for settlement for each product here.

4) After choosing product, you can decide whther you would like to buy or sell it. You only need to own USDT to trade USDT-margined futures. That is to say you can sell BTCUSDT futures without owing any BTC Coin.

5) Then select your order type, and choose your leverage.

If you choose Limit or SL/TP order, you will need to enter your order price here.

Enter the quantity or choose the percentage under the quantity field.

You can also set up stop loss or take profit targets to limit losses or maximise earnings.

6)After everything is set up, Buy or Sell to play your order. A confirmation window will show up, check if all info is correct and click [Confirm] to open the position.

| Download App for Android | Download App for iOS |

BTCC FAQs

1.Can U.S. traders use the BTCC exchange?

Of course, BTCC accepts US traders on its platform. They can sell, purchase, or trade bitcoins in the excess marketplace using the BTCC exchange. And, of course, any USD deposits must be KYC-verified first.

2.What can you trade on the BTCC?

BTCC allows users to trade over 300 crypto futures, including USDT-margined and coin-margined options. Traders can use up to 225x leverage to enhance their trades. Furthermore, the site provides handy choices for both cryptocurrency and fiat deposits.

3.Is BTCC the ideal exchange for you?

If Bitcoin trading is your top priority, BTCC is definitely the finest exchange for you. This company has been focused on Bitcoin since 2011 and provides a user-friendly platform for all types of traders, both experienced and new.

4.Is the BTCC Exchange trustworthy?

BTCC has a 13-year track record of secure operations, with zero security problems. Along with this, it has adopted current security measures, making it a safer and more trustworthy environment than its contemporaries.

About BTCC

BTCC is one of the world’s oldest and most popular bitcoin exchanges. Bobby Lee created it in 2011, with its headquarters initially located in Shanghai, China. BTCC contributed significantly to the early development of the Bitcoin and cryptocurrency ecosystems.

BTCC initially concentrated on Bitcoin trading, but it gradually expanded its capabilities to cover other cryptocurrencies as well. The exchange allows users to purchase, sell, and trade numerous cryptocurrencies, including as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), among others.

BTCC has received recognition for its strong trading platform, liquidity, and security precautions. The exchange provides features such as spot trading, margin trading, and futures trading to accommodate various types of traders and investors. It gives consumers real-time access to market data, order books, and trading charts, allowing them to make informed trading decisions.

BTCC has undergone various alterations throughout the years in order to adapt to the changing regulatory landscape. It expanded its activities abroad, opening offices in other countries to serve a global customer base. However, cryptocurrency legislation and availability may differ based on jurisdiction.

As the cryptocurrency market evolves, BTCC remains a significant player in the industry, providing a variety of services and contributing to the growth and development of the crypto ecosystem.

| Download App for Android | Download App for iOS |

BTCC Pros

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

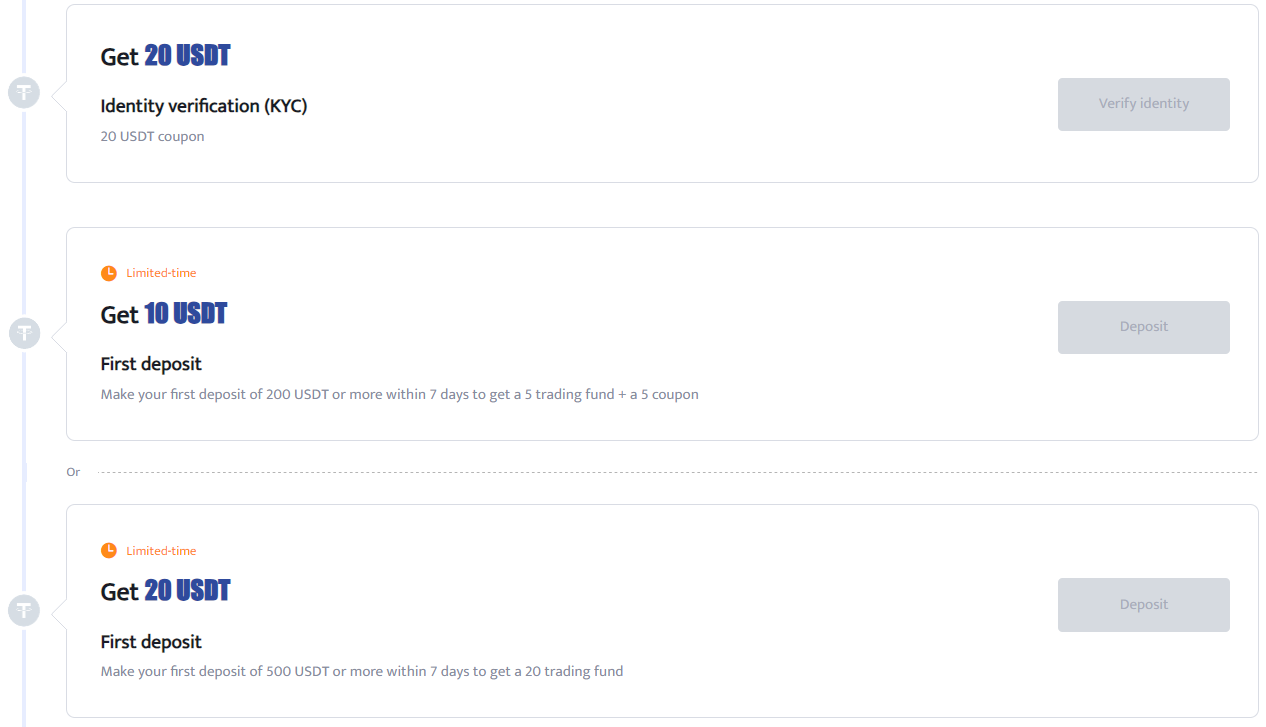

BTCC Bonus

BTCC bonuses apply to different categories of users. You can deposit and receive up to 10,055 USDT. Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

- Bonus On First Deposit And Trade

You will get a bonus worth 10 USDT when you deposit 200 USDT and above within 7 days of opening an account. The reward includes a 5 trading fund and a 5 USDT coupon.

If the deposit is 500 USDT and above, you will get a 20-trading fund. Furthermore, if you make a cumulative deposit of 2000 USDT within 30 days of opening an account, you will get a 30 USDT trading fund. Trading within 7 days of signing up will also earn you a 20 USDT coupon.

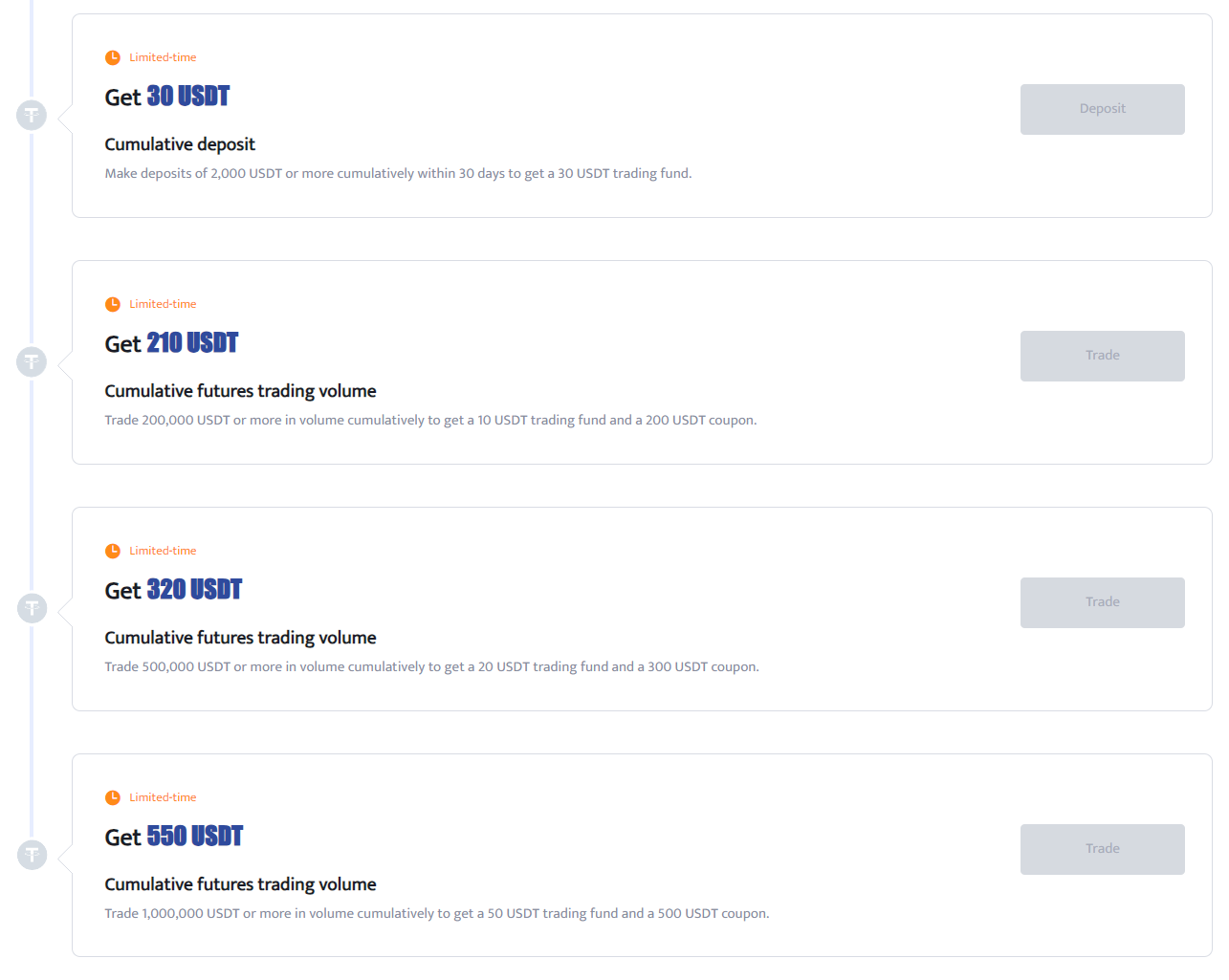

- BTCC Futures Trading Bonus

You can earn bonuses from trading futures on BTCC within a stipulated time.

- A cumulative future trade of 200,000 USDT and above will earn you a 10 USDT trading fund and a 200 USDT coupon.

- A cumulative future trade of 500,000 USDT and above will earn you a 20 USDT trading fund and a 300 USDT coupon.

- A cumulative future trade of 1 million and above will earn you a 50 USDT trading fund and a 500 USDT coupon.

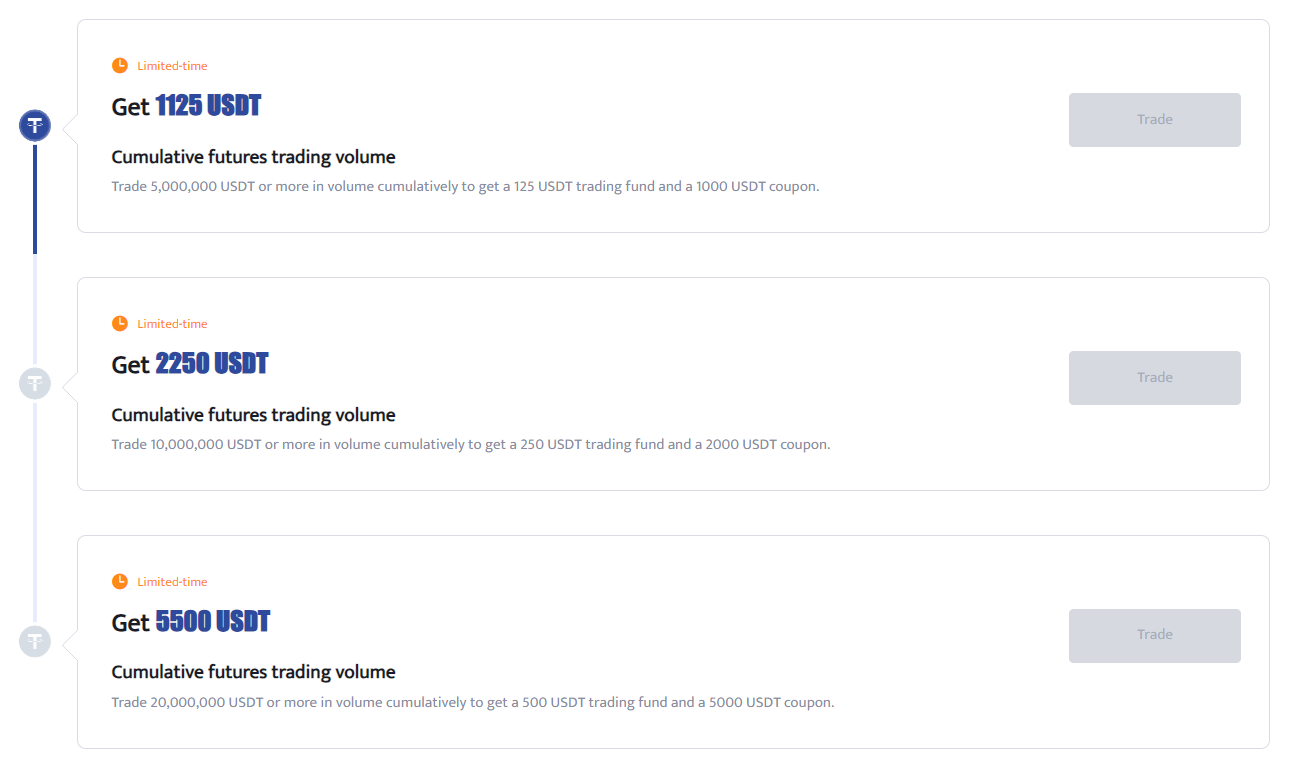

- A cumulative future trade of 5 million USDT and above will earn you a 125 USDT trading fund and a 1000 USDT coupon.

- A cumulative future trade of 10 million USDT and above will earn you a 250 USDT trading fund and a 2000 USDT coupon.

- A cumulative future trade of 20 million USDT and above will earn you a 500 USDT trading fund and a 5000 USDT coupon.

- Other Bonus

Invite a friend to BTCC to get a 25% rebate on their trading fees. You can get up to 530 USDT in rewards per referral.

Related Posts:

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

Best Crypto Exchange to Trade with Leverage

Best High Leverage Crypto Trading Exchange Platform

Here is a Cryptocurrency Scammer List of 2022

Free Crypto No Deposit Bonus For Signing Up 2022

Terra Classic Price Prediction- Will LUNC Hit $1?

Binance Learn and Earn Quiz Answers – LDO, WOO, QI Quiz Answers

Terra Classic Burn: The Reason Behind LUNC and LUNA Recent Spike

Apecoin Price Prediction 2022, 2025, 2030 – Will Apecoin Go Up?

Ripple (XRP) Price Prediction 2023, 2025, 2030 : Why Are XRP Prices So Low?

Solana (SOL) Price Prediction 2022,2050, 2030-Future of Solana?

Avalanche (AVAX) Price Prediction 2022,2025,2030 – Is AVAX a Good Investment?

Chainlink (LINK) Price Prediction 2023, 2025, 2030 – Is LINK a Good Investment?

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030 – Will DOGE Explode in 2023?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030 – Is BTC a Good Investment?

Litecoin Price Prediction 2023, 2025, 2030: Is Litecoin a Good Investment?

Dash Price Prediction 2023, 2025, 2030: Is DASH a Good Investment?

GMT Price Prediction 2023, 2025, 2030: Is GMT Coin a Good Investment?

Bitcoin Cash Price Prediction 2023, 2025 and 2030: Is Bitcoin Cash a Good Buy?

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030 – Is YFI a Good Investment

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Tron (Uniswap (UNI)) Price Prediction 2023, 2025, 2030 — Will Tron Hit $1?

Gala (GALA) Price Prediction 2023, 2025, 2030 — Is GALA a Good Investment?

Blur Price Prediction 2023, 2025, 2030: Is Blur Crypto a Good Investment?

Fantom (FTM) Price Prediction 2023, 2025, 2030—Is FTM a Good Investment?

Polkadot (DOT) Price Prediction 2025 – 2030: Is Polkadot a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*