Recommended

Natural Gas Forecast & Price Predictions 2024,2025,2030

2024/07/25By:

As the globe looks to replace fossil fuels like oil and coal with more renewable energy sources, natural gas is one such resource that is becoming more and more popular as a reliable source of electricity. In comparison to other fossil fuels, it emits less carbon, and the infrastructure surrounding gas plants is constructed far more quickly and easily.

This is another reason why the US in particular has made it a priority to put a lot of money and effort into generating natural gas. The US has also increased its reliance on natural gas as a result of this. Due to its increased reliance and potential significance for renewable energy in the future, this resource has now entered the commodities market.

Natural Gas Price History

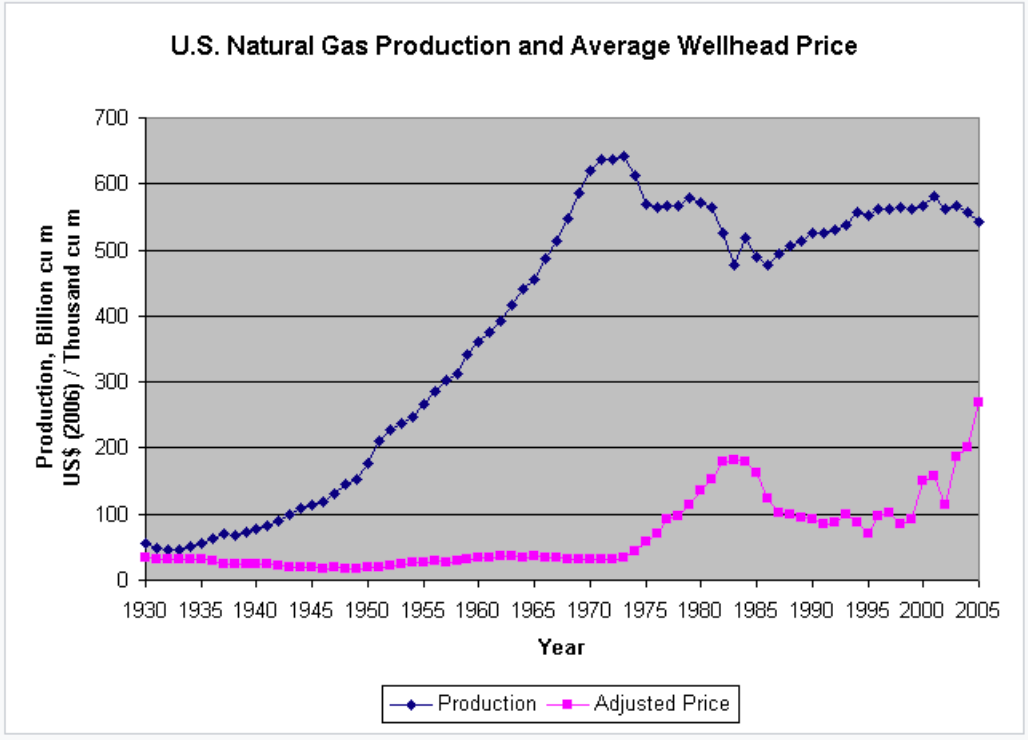

U.S. dry gas output has been steadily increasing since the 1930s to keep up with the demands of a rapidly growing population. While natural gas output peaked in the 1970s, it wasn’t until production began to decline that prices began to rise on the market.

Due to natural gas shortages in the Midwest in 1976 and 1977, schools and companies had to temporarily close due to a lack of supply. By 1975, the intrastate market had consumed about half of the US’s marketed gas.

Since 1990, when supply disruptions caused price spikes, these drops in supply have set the trend for natural gas price forecasts. While this has contributed to higher prices in the past, technological advancements and more supply have contributed to falling petrol prices in the modern period.

With the advent of horizontal drilling and hydraulic fracturing, the estimated recoverable reserves have risen to hundreds of trillion cubic feet, reducing the fear of running out. Since 2008, the spot price of natural gas has dropped significantly, and hydraulic fracturing is the reason behind it.

Natural gas’s price is highly sensitive to changes in supply and demand because it is a fossil fuel and there is an infinite supply. From 2000 to 2009, there were several supply outages and concerns about running out, as seen in the historical overview. However, shale gas has arisen, thanks to new mining technology, to alleviate these issues over the next hundred years.

| Download App for Android | Download App for iOS |

Natural Gas Price Forecast 2024-2025

Due to the large number of variables, it will be challenging to predict the price of natural gas for the next two to three years. After absorbing the first blow of the conflict in Ukraine, the natural gas market had extremely dull behaviour throughout 2023.

The price of natural gas soared to almost $10 in 2022, but then crashed for a while since the European winter wasn’t quite as harsh as predicted. Additionally, enough natural gas had been hoarded by the Germans and other European powers to last through the injection season.

At least temporarily, worries that removing Russian gas from the market would lead to a severe scarcity appeared to have been allayed. This has put an end to concerns of severe shortages.

In addition, natural gas output in North America is expected to remain stable. Prices lost a lot of their initial impetus due to the flood of supply caused by the reconstruction of the facility in Freeport, Texas, which allowed for the export of natural gas from the United States. Despite the fact that the future of natural gas is uncertain, the desire for it is clear.

One would expect a rebound in 2024 following the huge selloff last year. It should be noted that American production of liquid fuels has the potential to keep growing, which might lead to a pretty inexpensive market in the long run (though not quite as cheap as it was during the crash following the war in Ukraine).

As developing nations’ economies develop, the need for liquid fuels will rise, and some nations are attempting to reduce their carbon footprints. Natural gas is a cleaner fuel option than coal or oil, therefore it could be of interest to more environmentally conscious economies to use it in conjunction with renewable energy sources like wind and solar. The electric power sector, though, will make an impact.

The current natural gas price forecast and the natural gas price forecast for the next six months are likely to diverge significantly due to the ongoing market difficulties. The production and management of this resource makes the petrol price forecasts for the next five years an intriguing topic to follow.

Predictions and movements in petrol prices in the future are affected by a wide range of factors, including but not limited to: consumption, demography, economic growth, poverty, and weather. The use of natural gas for heating increases in colder weather, for example, which is a given. Temperature is another factor that influences demographics; for example, people in the United States often relocate to warmer regions, which reduces demand.

Market factors, such as economic development or slowdown, can also affect the petrol price projection, which can cause prices to climb or fall. On top of that, if petrol prices continue to rise, consumers may cut back on their use of the fuel, which increases supply and decreases demand.

Natural Gas Price Forecast 2030

Although there is some uncertainty about the energy market in the near future, it is important to remember that there is substantial evidence from the past to suggest that the energy sector, including natural gas and crude oil, will eventually recover.

At times, natural gas has been less appealing for net exports due to falling crude oil prices. However, technology is currently developing ways to transport liquefied natural gas exports much more effectively, so natural gas is expected to emerge victorious in the future.

In the coming year or two, as economies around the world begin to recover from the pandemic and the possible severe recession, we should expect petrol demand to rise. A healthy economy has a significant impact on electricity generation, which in turn has a substantial impact on natural gas prices.

Natural gas burns far cleaner than other energy sources, thus demand will certainly rise as concerns about sustainable energy grow. Natural gas, rather than crude oil, will likely be prioritised by many countries as a result of this. But, as gas is used to heat homes in the northern hemisphere, its increased demand is cyclical as well, so you should keep an eye on weather patterns.

| Download App for Android | Download App for iOS |

Natural Gas Price Forecast in the Future

Although it could be challenging to estimate petrol prices, the elements that drive them are obvious and readily apparent in the long term. Because of its long-term importance and sustainability, demand for this resource is only going to rise.

On the other hand, new technology and mining methods are making it easier to obtain the resource, therefore supply is also on the rise. Supply and demand must be balanced, but there is good news: demand is increasing quickly.

Given the unpredictable nature of wholesale power rates, it will be extremely important to generate energy from inexpensive fuel sources. This is particularly true for smaller economies that are referred to as “emerging markets.”

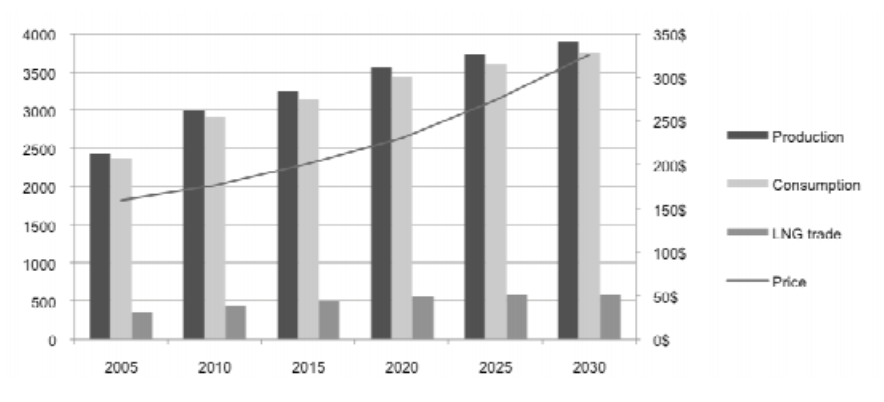

The industrial sector is the primary growth driver in Asian countries like Bangladesh, Pakistan, and India, and experts believe that their use would also increase significantly. Half of the world’s energy comes from natural gas, which is predicted to have a 3% yearly increase in usage.

When asked about their predictions for the future, experts have varied feelings, with the majority predicting a negative shift. For instance, according to the World Bank’s Commodity Markets Outlook, US natural gas prices are expected to stay at $2.80/MMBtu. The Energy Information Administration* predicts that natural gas prices will average $3.07/MMBtu in 2021. Natural gas is now selling at a higher price of $4.80/MMBtu.

What will Gas Price be Next 5 Years?

In particular, the push to make petrol the world’s greatest primary energy source will be the most influential factor in pushing petrol prices upward. This fuel has the potential to become an important worldwide fuel due to its lower environmental impact compared to other fossil fuels and its well-established production infrastructure.

By 2034, gas is predicted to surpass all other primary energy sources in terms of popularity. Additionally, peak demand is anticipated for this resource in 2035, making it the last of the fossil fuels to do so. However, its demand is expected to steadily increase over the next five years due to its compatibility with renewable energy sources.

Many market analysts also take gas in storage relative to the five-year average into account, which is an additional consideration that is appropriate for this gas estimate.

Petrol prices might be poised for a dramatic increase in the coming five years, according to Dwayne Purvis, a Texas-based engineering and management expert.

“Reality is obscured by the five-year range of storage, the standard frame of reference, due to the extreme demands of the 2014 “polar vortex” and the chronic gas shortage.”

Since demand has consistently outpaced supply, storage has been on a downward trend for the majority of the past three years. As storage did not grow in tandem with production, normalised storage volumes have been trending downward for nearly a decade when looking at a longer time frame. There was just enough fuel for 12 days of use at the end of last winter’s heating season due to these overlapping trends.

What will Gas Price be Next 10 Years?

Consistent with the five-year forecast for natural gas prices, the demand for energy and cleaner fossil fuels will cause prices to rise consistently over the next decade. Indeed, numerous industry experts continue to concur on the average projection of a 3% price increase, even when looking out a decade.

When making long-term projections concerning this asset, it’s crucial to consider how the world can balance increasing demand and supply, as well as how the market will react to these changes. There is little question that petrol consumption will increase; the key is that production and supply must keep pace with demand, not exceed it, if petrol prices are to continue to climb in tandem with demand.

The only other factor that could impact gas prices in the long run is the supply from the newly-discovered US shale gas resources, which have lately entered the market and brought a lot of supply, which has dampened prices to some extent.

Shale has the potential to slightly lower prices, according to McKinsey’s North American Gas Outlook to 2030:

Our forecasts for supply and demand indicate that petrol prices in North America should be relatively unchanged for the foreseeable future. Prices should fall to about $2.50 per million British thermal units and stay there for the long future due to the increasing availability from Shale resources, especially associated gas. If these prices remain, North America should have enough to last for at least another quarter of a century.

What Affects Natural Gas Prices?

Forecasts for natural gas prices are affected by a wide range of external variables, such as population growth, economic development, fuel use, storage, exports, and poverty rates. Nevertheless, it is equally crucial to consider elements that affect the demand and supply sides of the price projection.

Prices are influenced by three main elements on the supply side:

- Volume of petrol Created

- Quantity of Natural Gas at Storage Establishments

- Trade in Natural Gas: A Quantity View

Prices are influenced by three main demand-side factors:

- Temperature swings between summer and winter

- Rate of expansion of the economy

- Alternative fuels’ availability and pricing

The production and supply of dry natural gas play a significant role in setting market prices for this commodity. A surplus will result in reduced prices if supply is increased above what is needed or is caused by causes like cold weather. New drilling and mining techniques, as well as the Shale energy movement, have contributed to an increase in supply, which has been noticed.

Especially when natural gas reserves are limited and new gas deposits are hard to come by, market participants anticipate a rise in price due to concerns about a potential shortage. Once again, the premise that these resources would remain untapped for another hundred years was central to the American shale gas movement, which sought to maintain a steady supply at a low price.

Residential heating accounts for the vast majority of natural gas consumption from a demand perspective. The intensity of a winter’s grip can cause a spike or dip in demand for this gas, making it very seasonal.

Furthermore, as petrol is associated with people’s prosperity, its demand can rise in response to improved market economic performance. As the economy improves, more people can afford petrol and use it more frequently, driving increasing prices.

Even though petrol is a resource that people may use for heating and other purposes, there are alternatives to petrol, so if its price rises too much due to strong demand, people can switch to other fuels, bringing the price down.

| Download App for Android | Download App for iOS |

Natural Gas Price Forecast: Conclusion

Natural gas has promising future prospects as both a resource and a commodity. Due to its superior sustainability and environmental friendliness, this resource is seeing ever-increasing usage as the fossil fuel industry strives to meet rising expectations.

Natural gas production is also being increased in anticipation of future demand. However, this increase is happening in spurts rather than a steady stream due to factors such as the growth of shale fuel, which has increased supply and decreased demand, resulting in lower prices. On the plus side, this has made natural gas more accessible and useful for emerging industries.

Natural gas prices are expected to rise at a rate of 3% per year, and this rate could accelerate when traditional fossil fuels are no longer used. Natural gas is trading at a cheap price right now, which suggests a quick upswing this year and an excellent opportunity to invest for the long haul.

Natural Gas Price Forecast:FAQs

Are natural gas prices predicted to rise or fall?

Natural gas costs are generally predicted to rise by roughly 3% annually due to rising demand, which will be countered by rising supply and the introduction of shale gas energy.

What is a reasonable natural gas price per therm?

Season, location, and other variables can have a big impact on the average cost of natural gas per therm. A decent average, meanwhile, is more like $0.90 than $1.

Do wintertime prices for natural gas increase?

Indeed, the demand for natural gas, which is used for cooking and heating, peaks in January and the winter months, which is why the price of gas typically peaks at the start of the year.

Is it wise to fix my natural gas rate?

It is preferable to lock into a fixed price contract for natural gas because it is often regarded as a longer-term investment due to its consistent price growth.

| Download App for Android | Download App for iOS |

Where to Trade Crypto Futures?

You can trade crypto futures on BTCC Now. Over 300 USDT-margined perpetual trading pairs are available for users to trade, including many popular altcoins and meme-coins.

You can deposit and receive up to 10,055 USDT now when you sign up and verify your account on BTCC Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

About BTCC

BTCC is a leading cryptocurrency trading platform that is distinguished by its ability to balance the simplicity of use with advanced features. It provides a comprehensive educational program through the BTCC Academy, 24/7 customer support, and robust security to both novices and experts. BTCC is a top choice for digital asset investors due to its emphasis on user contentment, which fosters a secure and informed trading environment across a variety of cryptocurrencies.

BTCC is one of the few exchanges in the market that offers high-leverage options for investors and concentrates extensively on futures trading. Users have access to more than 300 USDT-margined perpetual trading pairs, which encompass numerous prominent altcoins and meme-coins. Additionally, the platform has recently implemented spot trading to facilitate novice users who may not be acquainted with futures trading.

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*